- Home

- Platform

- Risk & Compliance

AI-powered compliance built in, not bolted on

Constantinople keeps your bank compliant without slowing you down. Compliance is built into every product, process, and workflow, not added after the fact. AI continuously monitors behaviour, detects risk, and enforces controls in real time, reducing overhead and strengthening protection.

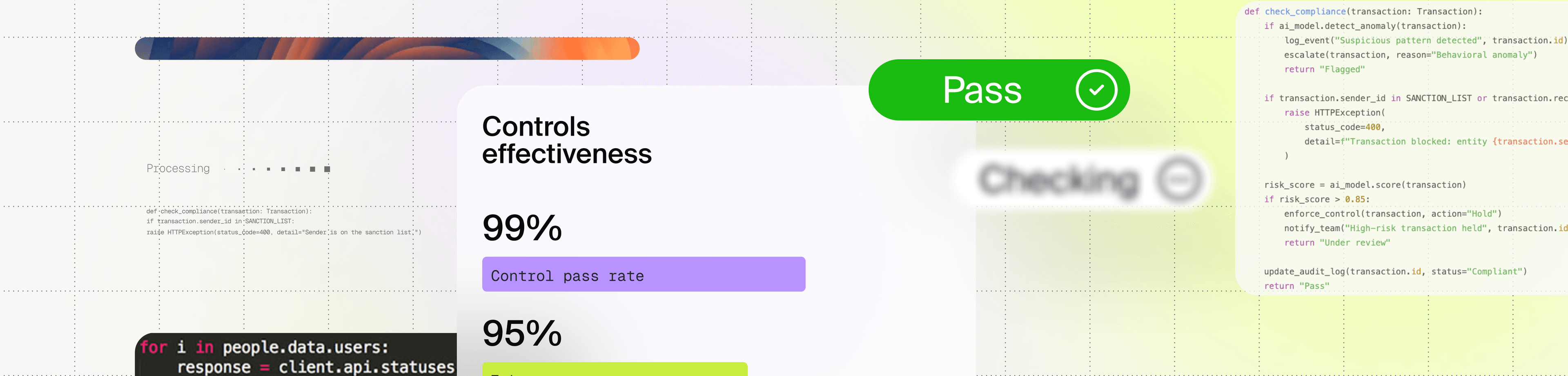

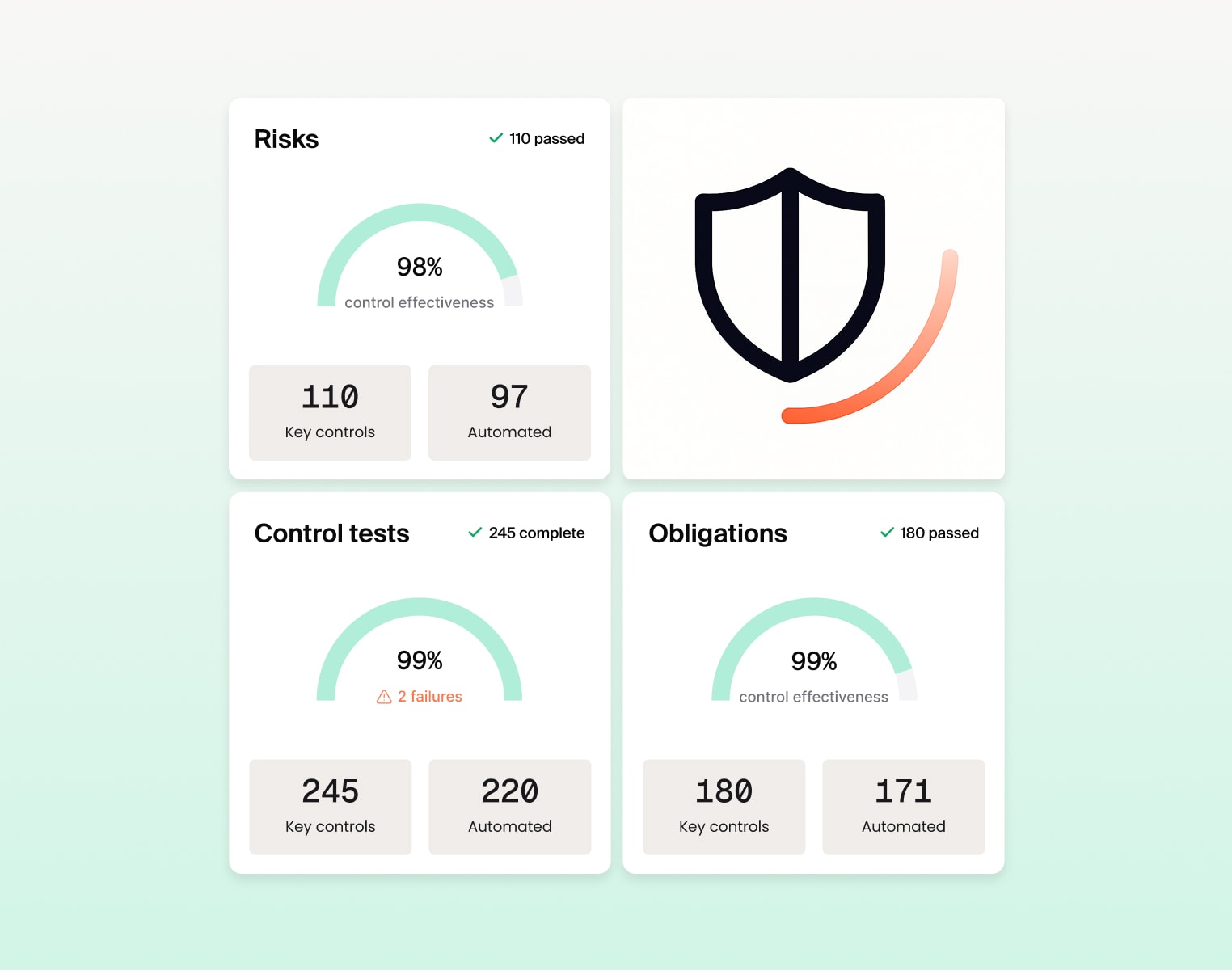

Controls & audit

Embedded oversight and automated controls give you real-time visibility and protection across your obligations.

Every product and workflow is governed by AI-driven rules that prevent issues before they arise, giving you complete confidence and control. Compliance isn’t an overlay, it’s built into the platform.

Regulatory obligations mapped with automated controls

Human oversight to ensure AI alignment and effectiveness

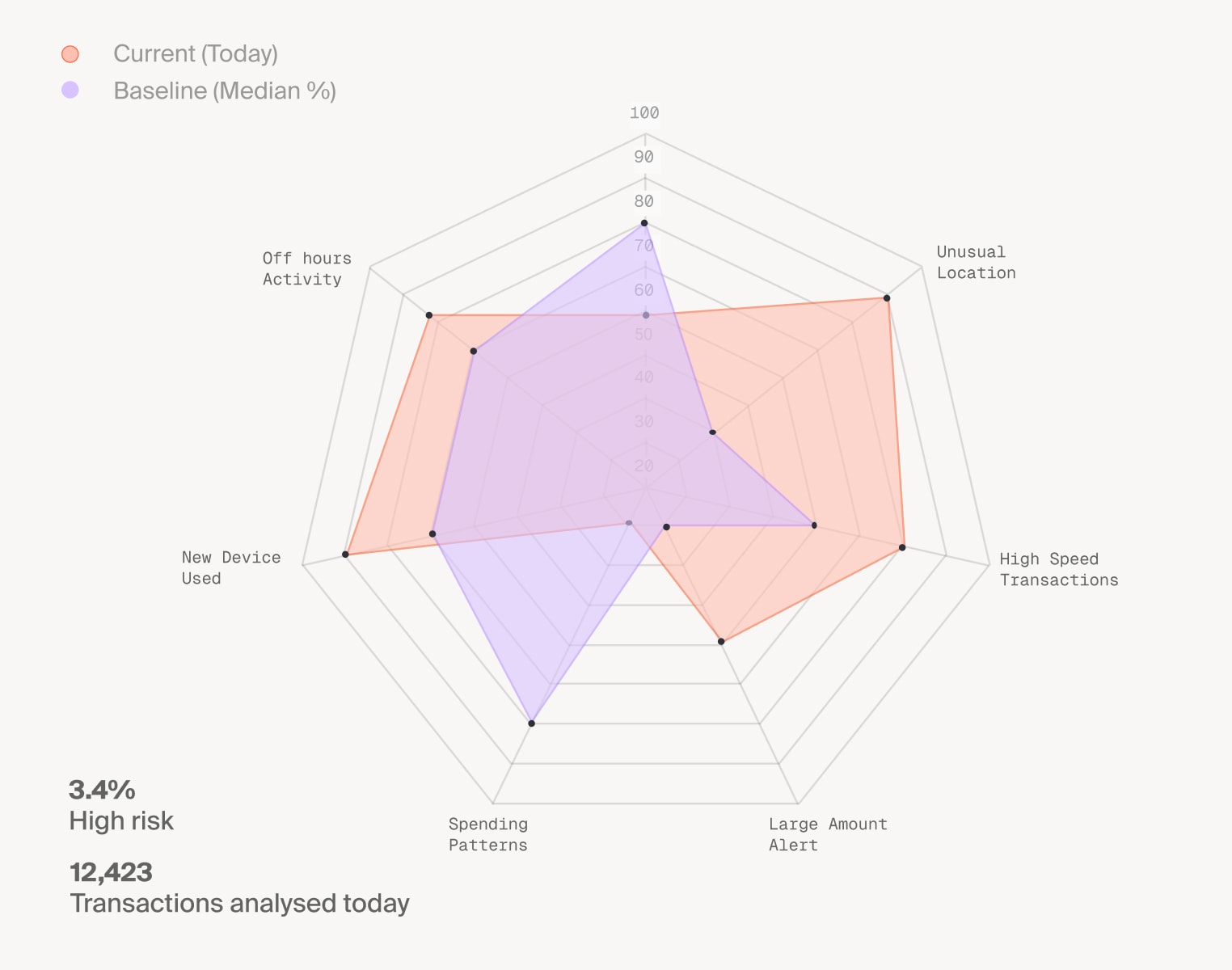

Financial crime

AI-powered detection that adapts as threats do.

Constantinople embeds advanced financial crime controls across every product and channel with full AML/CTF compliance built in. AI detects and adapts to emerging threats in real time, automatically triaging cases, and stopping risks before they spread.

Real time AML prevention and compliance insights

AI powered investigations

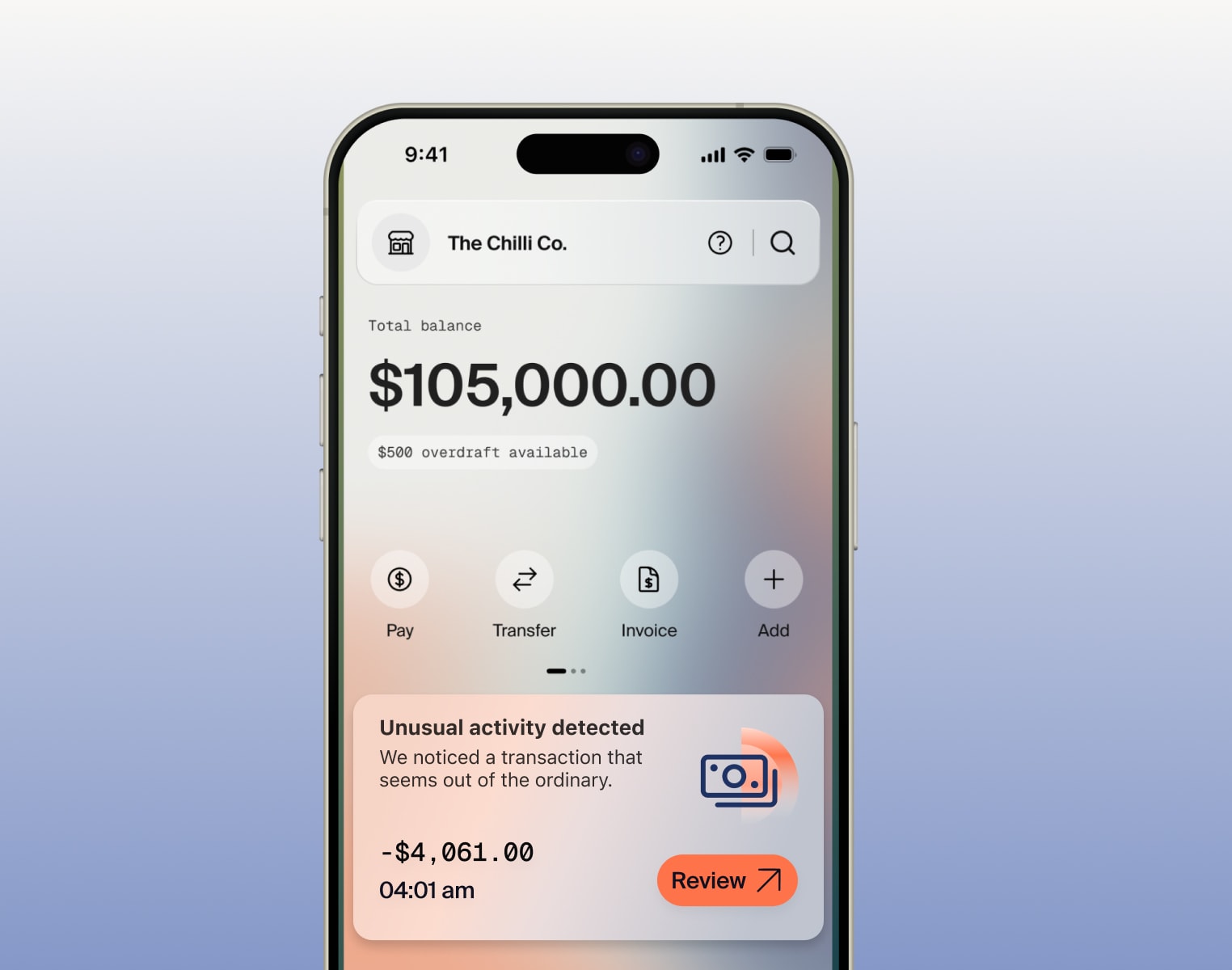

Fraud prevention

Real-time 24/7 protection without compromising experience.

AI analyses transactions and behavioural patterns as they happen, delivering instant decisions with minimal false positives. Suspicious activity is escalated to our 24/7 fraud operations team, ensuring rapid investigation and resolution protecting customers without slowing them down.

Real time fraud prevention

24/7 frontline fraud team

Rapid investigations and resolutions

Regulatory reporting

Submission-ready reporting or integrate with your existing platform.

Automated, submission-ready reports meet jurisdictional requirements with precision. Delivered directly to the regulator or fed into your own reporting stack, cutting manual effort and audit risk.

Submission-ready reports tailored to jurisdictional requirements

Streamlined data feeds into your General Ledger and reporting platforms

Supports APRA, ASIC, AUSTRAC, ATO, and ACCC in Australia (plus equivalent regimes in other operating markets)

Documentation & assurance

Platform transparency, independently verified.

Every layer of the platform is documented and backed by independent assurance where it matters most so you can trust exactly what's running your bank.