- Home

- Platform

- Bank Products

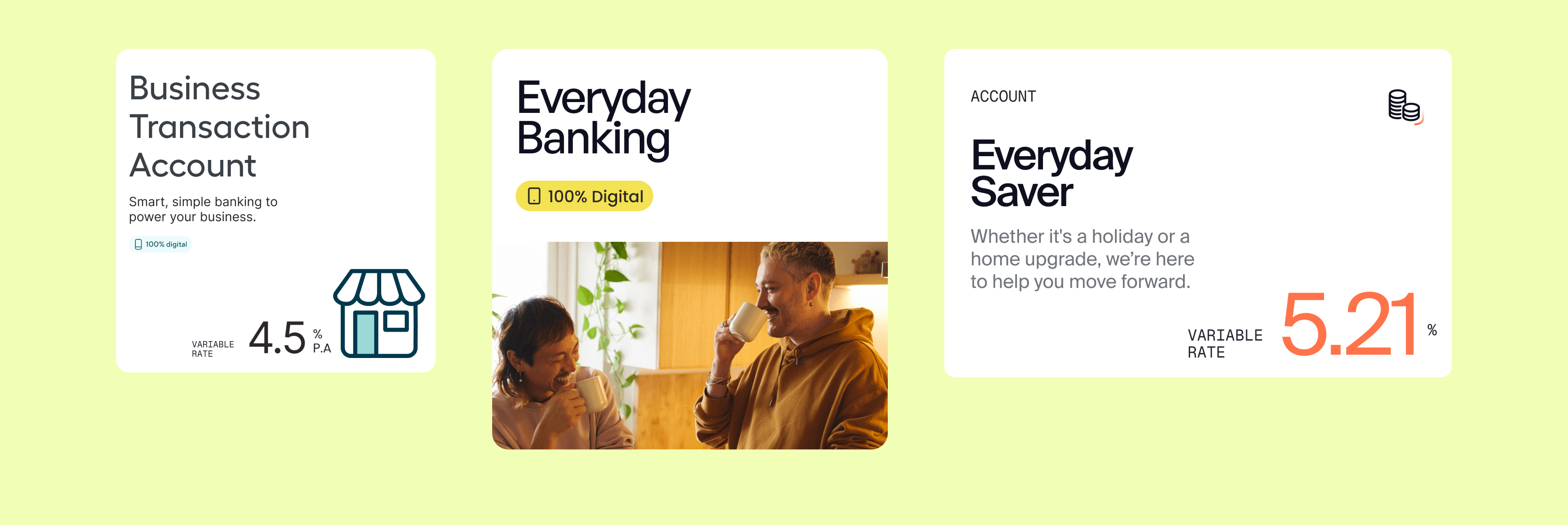

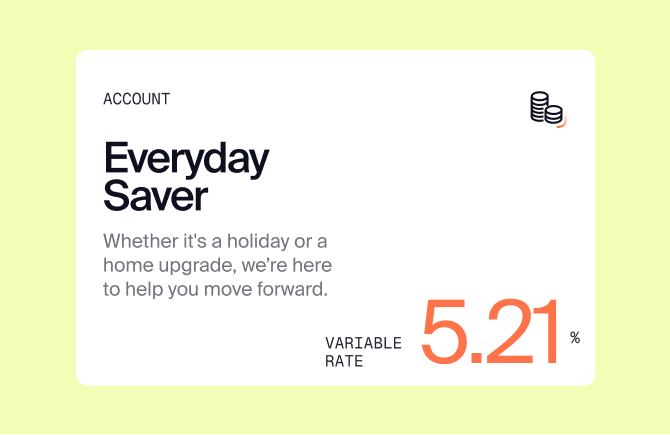

Configurable bank products

Accounts

Deposit accounts, built for modern banking.

Constantinople supports a wide range of retail and business accounts, fully configurable to your product strategy, pricing, and customer experience.

Modern transaction accounts for individuals and businesses.

Core features

Configurable fees, interest rates and product bundles

Custom account naming

Self-service statements and mailhouse integrations

Accounting software integrations (e.g. Xero, MYOB)

Data access controls and multi-user permissioning

Payments & transfers

Integrated debit card with Apple Pay & Google Pay

Instant digital wallet provisioning

Real-time payments and scheduled transfers

Bill payments

Payment approvals, limits and cut-offs

Cash deposit support (via branch)

Automated sweep functionality

International payments (coming soon)

Money management tools

Smart insights and spend categorisation

Enriched transactions with merchant logos and maps

Powerful search, filters

Receipt capture, tagging and custom categories

Budgeting tools and automated spend analysis

Balance alerts and proactive notifications

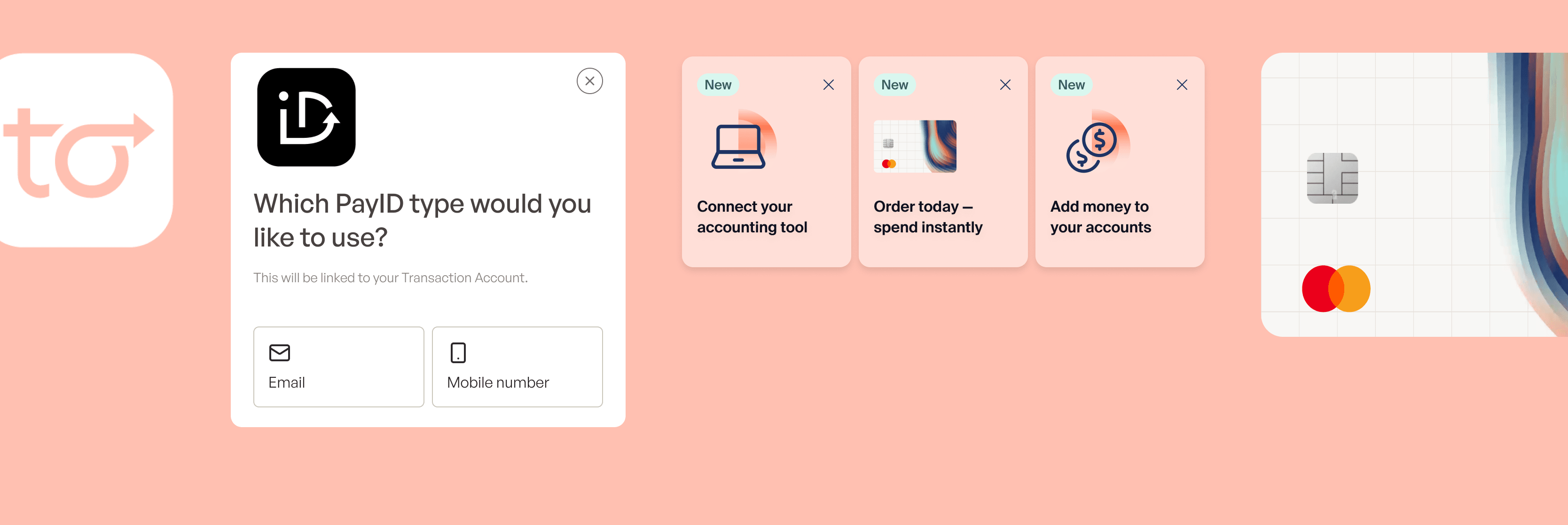

Payments

Integrated, intelligent payments built into the platform.

Constantinople manages the operation of payment networks so your teams don’t have to. We deliver end-to-end payments for individuals and businesses, across real-time, scheduled, and bulk channels with built-in controls, automation, and visibility.

Our orchestration layer supports ISO 20022 and real-time rails across key markets, with adapters for domestic and cross-border payments.

Real-time payments

PayID (use mobile or email)

Recurring payments with pre-authorised payees

Bill payments with scan and autopay

Bulk clearing for batch payments and payroll

Cross-border payments and FX (coming soon)

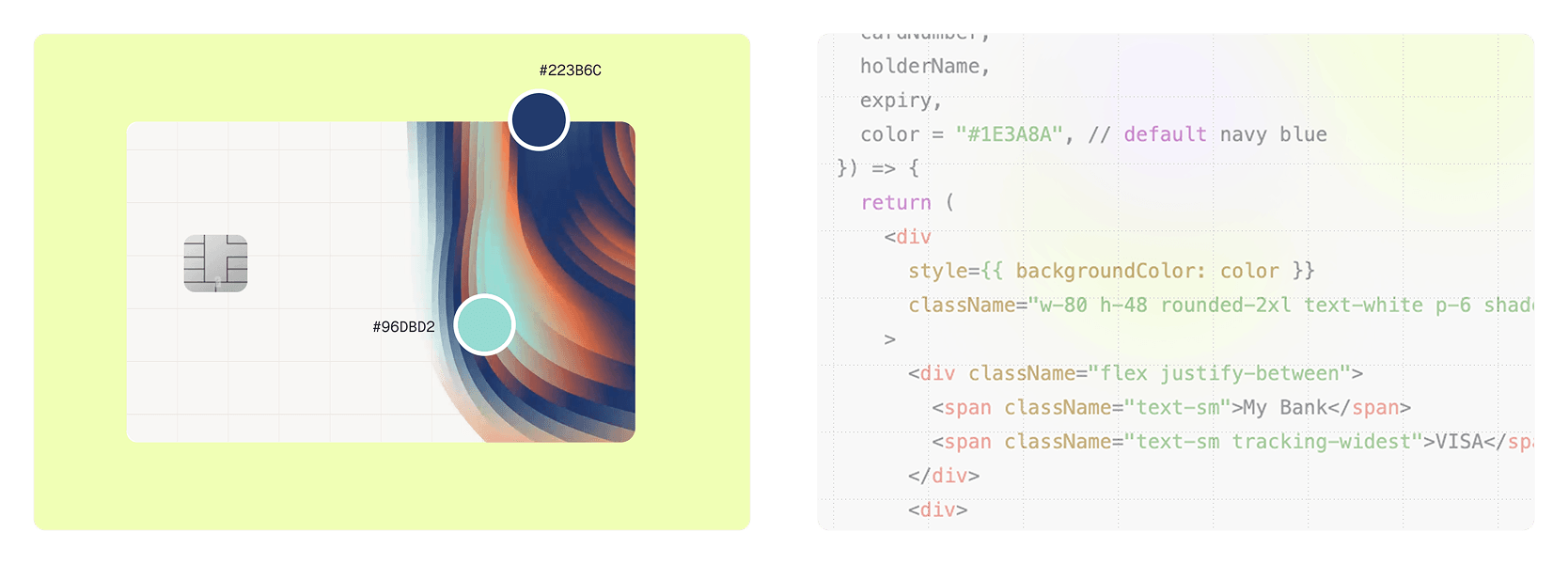

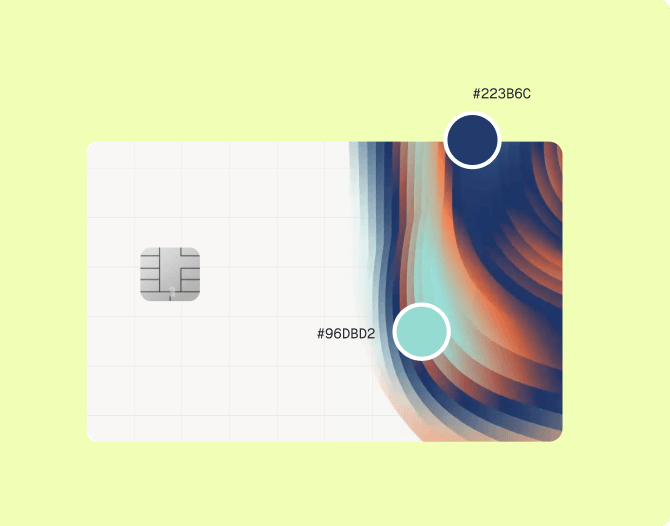

Cards

Modern debit and credit cards issued, managed and customised for your brand.

Launch debit, credit, and rewards cards for retail and business customers.

Issue fully branded physical and digital cards with instant activation and full lifecycle control.

Custom card artwork and design

Physical card EMV chip, contactless and embossing

Instant wallet provisioning (Apple Pay & Google Pay)

Real-time spend tracking and notifications

Self-service activation, replacement and cancellation

Fully integrated with customer accounts

Secure APIs for custom app experiences

Mortgages

Fully configurable end-to-end mortgages.

Constantinople supports a full spectrum of home loans fully configurable to your needs. AI-assisted originations and automated credit decisioning accelerate time to yes, while built-in servicing workflows handle everything from variations to hardship.

Support for a variety of home loans.

First home buyers with specialised assessment flows

Home purchase applications, including pre-approvals

Refinance applications

Broker-originated applications

Reverse mortgages

Construction loans with progressive drawdown management

Workflows to support a wide range of borrower types.

Individual borrowers (employed and self-employed)

Joint applications with multiple applicants

Trusts and SMSFs

Business entities (sole traders, companies, partnerships)

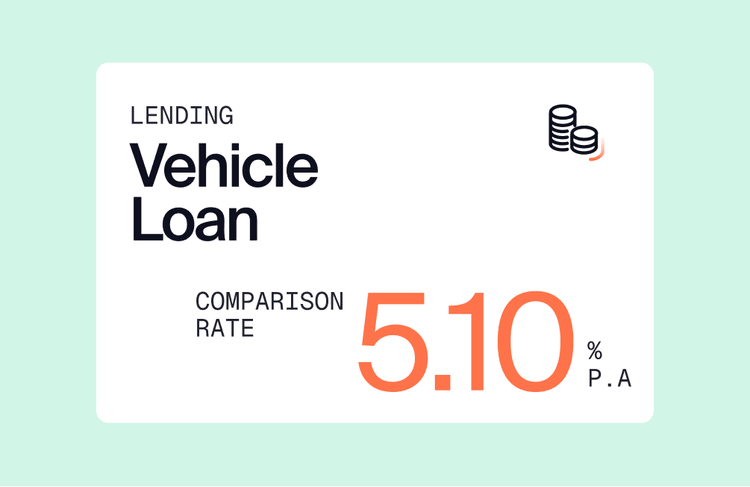

Consumer & business loans

Flexible lending products. Secured or unsecured, retail or business, all fully automated.

Constantinople supports a full suite of personal and business credit products, with origination, decisioning, and servicing built into the platform.

Support secured and unsecured lending products for consumers with fast origination, flexible configuration and full lifecycle servicing.

Personal & vehicle loans, credit cards, overdrafts

Integration with asset registers for instant valuation

Digital acceptance of contracts, disclosures and terms

Real-time loan funding and security registration

Configurable terms, rates and fee structures

Smart notifications for limits, repayments and fees

End-to-end servicing

Digital origination with AI credit decisioning, serviceability assessment and income verification